Shift Towards Mobile Advertising

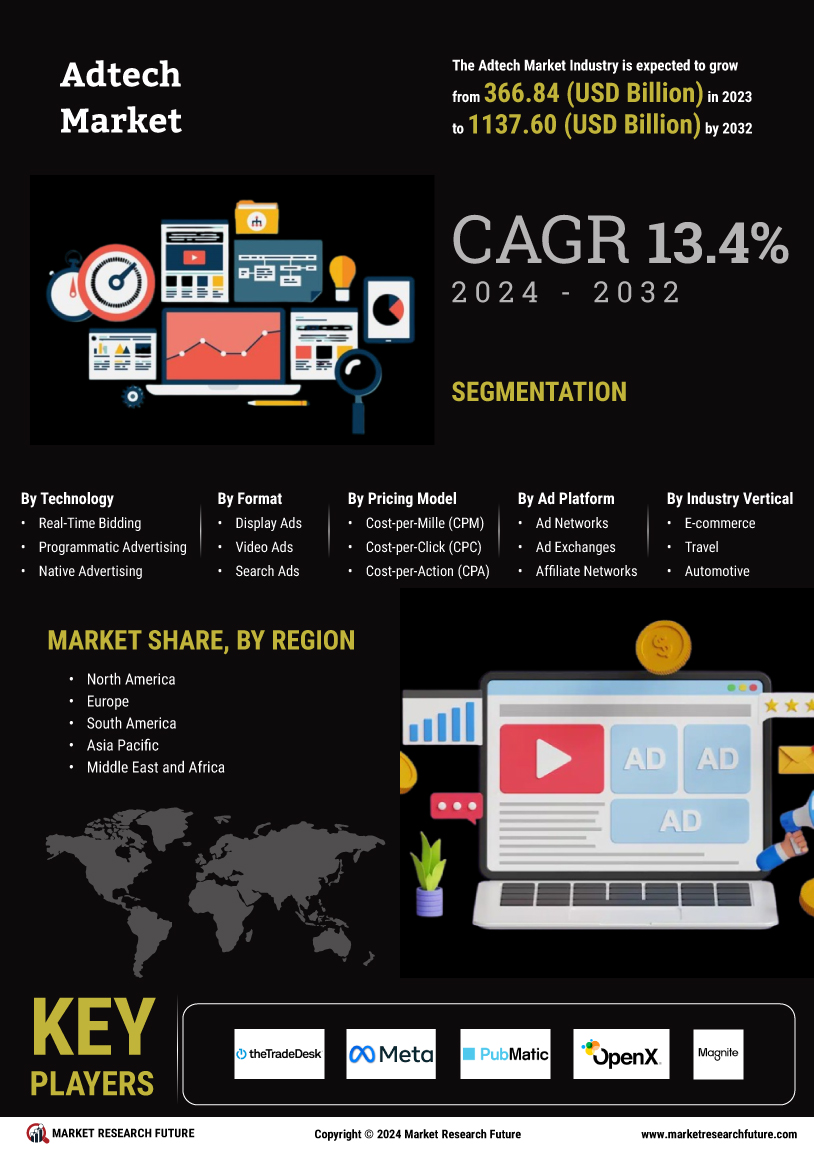

The Adtech Market is witnessing a significant shift towards mobile advertising, driven by the increasing use of smartphones and mobile devices. As of 2025, mobile advertising is expected to account for over 70% of total digital ad spending, reflecting a fundamental change in consumer behavior. This trend is fueled by the convenience and accessibility of mobile platforms, which allow advertisers to reach audiences in real-time. Moreover, advancements in mobile ad technologies, such as location-based targeting and interactive formats, enhance user engagement. Consequently, businesses are reallocating their advertising budgets to prioritize mobile channels, thereby stimulating growth within the Adtech Market.

Emergence of Data-Driven Marketing

The Adtech Market is experiencing a pronounced shift towards data-driven marketing strategies. Companies are increasingly leveraging vast amounts of consumer data to tailor their advertising efforts. This trend is underscored by the fact that data-driven marketing can lead to a 20% increase in sales, as businesses utilize analytics to understand consumer behavior better. The ability to segment audiences and personalize content enhances engagement, thereby driving higher conversion rates. As organizations prioritize data collection and analysis, the demand for sophisticated adtech solutions that can process and interpret this data is likely to surge. Consequently, the Adtech Market is poised for substantial growth as firms invest in technologies that facilitate data-driven decision-making.

Growing Demand for Video Advertising

The Adtech Market is experiencing a burgeoning demand for video advertising, which has become a preferred medium for engaging consumers. Video content is known to capture attention more effectively than static ads, leading to higher engagement rates. As of 2025, video advertising is projected to represent nearly 50% of all digital ad spending, highlighting its critical role in marketing strategies. The rise of platforms such as YouTube and TikTok has further accelerated this trend, as advertisers seek to capitalize on the popularity of video content. This shift not only enhances brand visibility but also drives conversions, making video advertising a pivotal component of the Adtech Market.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning is reshaping the Adtech Market. These technologies enable advertisers to optimize campaigns in real-time, enhancing targeting precision and improving return on investment. For instance, AI-driven algorithms can analyze user interactions and predict future behaviors, allowing for more effective ad placements. The market for AI in advertising is projected to reach approximately 40 billion USD by 2025, indicating a robust demand for innovative solutions. As advertisers seek to maximize their impact, the incorporation of these technologies into adtech platforms is likely to become a standard practice, further propelling the growth of the Adtech Market.

Increased Emphasis on Cross-Channel Marketing

The Adtech Market is increasingly emphasizing cross-channel marketing strategies, which allow advertisers to engage consumers across multiple platforms seamlessly. This approach is essential in a landscape where consumers interact with brands through various channels, including social media, email, and websites. By integrating campaigns across these channels, businesses can create a cohesive brand experience that enhances customer loyalty. Research indicates that companies employing cross-channel marketing strategies can achieve a 30% higher customer retention rate. As advertisers recognize the importance of a unified approach, the demand for adtech solutions that facilitate cross-channel integration is likely to grow, further driving the evolution of the Adtech Market.